Contents:

Why would commercials increase their exposure in a week when prices traded higher? More often than not, the reason lies in a fundamental shift in their perception of cheap or expensive valuations. We took advantage of this information and evaluated the behavior of these three groups using the COT reports from 1983 to 2013. The analysis showed us how the big players position themselves before rally. The COT report essentially shows the net long or short positions for each available futures contract for three different types of traders.

Trade their accounts and earn a substantial percentage of the profits you generate, up to 90%. Weekly Close Price represents the price action of the underlying currency pair. When it’s at the lows, they believe that chances are high that the market will undergo a reversal. Investment banks and large hedge funds are also put in this category because they want to protect themselves from these sudden changes.

You can see an example of what this looks like below with crude oil futures. I have highlighted a few features that I have already talked about in the last section. If a major currency has a net long or short of 100,000 contracts, that would generally be viewed as being extended.

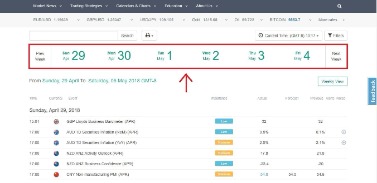

However, the RSI indicator did not follow the price and thus, created a price divergence . It is important to mention that the validity of a COT-signal lasts for approximately 6 weeks. If you are interested in trading based on COT reports, you might find our COT strategy useful. Traditional trading lore has it that the way to use COT data is to “follow the commercials.” In FX, this is not always the best advice. The Market Heatmap page shows you a quick summary on the day of what is up and what is down. Hop over to this page at any time to see what markets are performing the best or the weakest on the day.

Sign up for our newsletter

The report is prepared by the Commodity Futures Trading Commission . It is an excellent trading tool and can be used as an indicator for analyzing market sentiment. Markets are only included if 20 or more traders hold positions equal to or above the reporting levels established by the CFTC and the respective exchanges. The report uses data provided by reporting firms like clearing houses and forex brokers. It publishes the overall holdings of different assets by commercial traders, non-commercial traders, and retail traders to promote the transparency in the commodities and futures market.

This report shows a breakdown of open interest positions in three different categories. These categories include non-commercial, commercial, and index traders. Reportable traders that are not placed into one of the first three categories are placed into the «other reportables» category. The traders in this category mostly are using markets to hedge business risk, whether that risk is related to foreign exchange, equities or interest rates. This category includes corporate treasuries, central banks, smaller banks, mortgage originators, credit unions and any other reportable traders not assigned to the other three categories. Between 74-89% of retail investor accounts lose money when trading CFDs.

Commitment of traders report (COT): – FOREX.com

Commitment of traders report (COT):.

Posted: Mon, 23 May 2022 07:44:04 GMT [source]

The original or Legacy COT report is the most popular and has been used by currency traders for the longest period. It breaks long, short and spread position reporting down into Non-Commercial, Commercial and Non-Reportable categories. For example, traders are classified as non-commercial or commercial, and that holds for every position they have within that particular commodity. This means that an oil company with a small hedge and a much larger speculative trade on crude will have both positions show up in the commercial category.

Commitment of traders report (COT):

The COT provides an overview of what the key market participants think and helps determine the likelihood of a trend continuing or coming to an end. If commercial and non-commercial long positions are both growing, for example, that is a bullish signal for the price of the underlying commodity. The report provides investors with up-to-date information on futures market operations and increases the transparency of these complex exchanges.

Previous Restructuring May Minimise Impact of Credit Suisse Sale on FX Market – Finance Magnates

Previous Restructuring May Minimise Impact of Credit Suisse Sale on FX Market.

Posted: Fri, 31 Mar 2023 11:23:09 GMT [source]

We tested the strategy with the historical data and gained a clear understanding about the possible drawdowns, losing trades etc. That gave us the required confidence for our small trading account. The COT report can be used in the same way that you might use a traditional technical indicator that only analyzes price and time.

In many cases, the hedgers are usually very bullish when the market is at the lows and very bearish when an asset is trading in the highs. In trading, sentiments offered by other investors and traders are very important in determining the market moves. This is simply because any person trading the market has his own opinion on the future price of the shares, currencies, or commodities. Forex traders may use currency derivatives COT reports to find large net long or net short positions.

Partner exchanges

You could also download the data into a spreadsheet and make up your own chart. The charts of most software will show commercials vs. speculators as they raise and lower their positions over time. You can often see a turning point when one or the other changes direction. The disaggregated COT report is another one that is commonly known by traders.

As an example, let’s say dealer A creates a customized https://g-markets.net/ product for investor B . When an anomaly occurs, and we spot a dropping market that finds no increase in the total net exposure of dealers, that is a clue that their need to hedge against products they allocated is more limited. Hence, sending a signal that the market could be on the cusp of a turnaround.

Weekly Chart of AUD/USD covering the same period as the COT chart above

After a long delay due to a cyberattack on the CME commitment of traders report forex, the weekly COT report now returns as per usual as the backlog of data has now been filled. Notice that the Red bars are all pointing down, which indicates that the Commercials are all selling, or going short. Notice that the Blue bars are all facing up, which means the Large Speculators are buying, going long in the market. Basically, the Red guys, the big Commercials are selling their contracts to the Blue guys, the Big Speculators. Look at the little Green guys, they are the Small Speculators, guys like you and me, who are also going short, or selling, that’s why their bars are all facing down too.

The COT report is a powerful tool that gives any trader the flexibility to follow different paths when creating their trading strategy. The most important part is to remember that the COT data is another tool and shouldn’t be used alone when making a trading strategy. Conservative traders look at the COT as a way to check if the volume traded compliments use technical analysis. This type of trader will avoid making a move on a pair if the COT signals something opposite to what their study suggested.

Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512. References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. Being a weekly report, COT provides traders with up-to-date information on the happenings in the futures market. This makes it a lot easier and less risky for forex traders to arrive at right decisions and execute their trades. Not just for the traders, but even for researchers, COT report has much to offer.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Spot Gold and Silver contracts are not subject to regulation under the U.S. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite.

Although this report is from the futures market, we can use this information in spot currencies and CFD trading since spot forex pairs go hand to hand with currency futures and futures Commodities, Metals and Indicies are same as their CFD counterparts. The COT Report shows approximately 70 – 90% of open positions at futures markets. The goal of this report is to provide transparency to the futures market and prevent price manipulation. Both the sentiment line and the net long/short line are important trend indicators. Short term traders may use the sentiment line to define what kind of trades they are looking for based on the direction or trend of the red line. Longer term traders may only select trades that conform to the net long or short position of the black line.

For example, we can apply filters to the report in order to understand not just whether traders are net long or short but whether they are becoming more or less bullish and bearish. That shift in investor sentiment can help predict the “flip” and can even be used to trigger a trade entry or exit. The change in long or short positions can tell us a little bit about the trend in investor sentiment. Long positions have declined since last week and short positions have increased. This seems to indicate that there is some decline in bullish sentiment. As the COT reports are linked to the futures market, it can be used for Forex trading on those currency pairs that do have futures contract.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading office with us. DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube. For instance, if a sudden interest rate decision is made, the fact is that the market will react suddenly and many people will lose money. On the other hand, in early November 2009, the net long positions hit an extreme. Since there were no more buyers, the pair started to move downwards.